Introduction

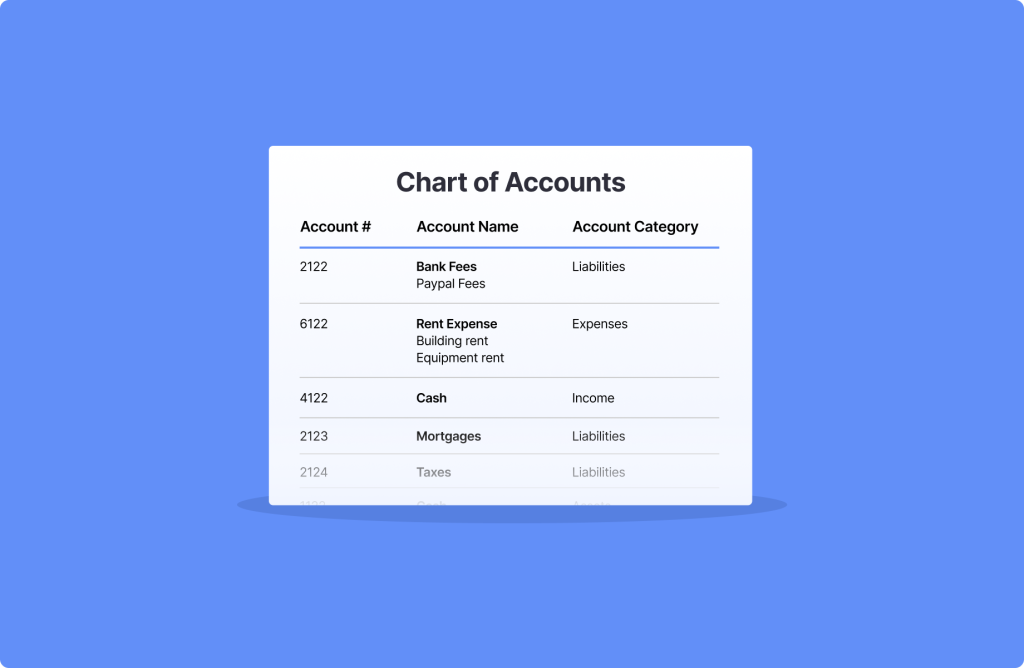

A chart of accounts is a list of all the accounts that a company uses to record its financial transactions. It is an essential tool for tracking income and expenses, and for generating financial reports.

The ideal chart of accounts for a tech startup will vary depending on the specific business model and industry. However, there are some general principles that can be applied.

General Principles

The chart of accounts should be organized in a way that makes it easy to track and report on the company’s financial performance.

The chart of accounts should be detailed enough to provide meaningful information, but not so detailed that it becomes cumbersome and difficult to use.

The chart of accounts should be consistent with industry best practices and accounting standards.

Recommended Accounts

The following is a list of recommended accounts for a tech startup:

Assets

Cash and Cash Equivalents

Accounts Receivable

Prepaid Expenses

Inventory

Fixed Assets (e.g., computers, office equipment, furniture, fixtures)

Intellectual Property

Other Assets (e.g., security deposits)

Liabilities

Accounts Payable

Deferred Revenue

Credit Cards

Payroll Liabilities

Payroll Tax Liabilities

Sales Tax Liabilities

Accrued Expenses

Long Term Liabilities (e.g., convertible notes)

Equity

Common Stock

Preferred Stock

Retained Earnings

Revenue

E-Commerce Sales

Service Income

Cost of Goods Sold

Cost of Services – Hosting

Operating Expenses

Salaries & Wages

Payroll Taxes

Payroll Fees

Benefits

Rent

Utilities

Repairs & Maintenance

Insurance

Shipping & Postage

Fulfillment Fees

Marketing & Advertising

Public Relations

Digital Advertising

Conferences & Tradeshows

Promotional Expenses

Independent Contractors

Research & Development – Subscriptions

Software Subscriptions

Computer Services

Office Expenses

Set-up Cost

Legal & Professional Expenses

Accounting Expenses

Traveling Expenses

Bank Charges

Other Income and Expense

Interest Income

Interest Expense

Depreciation

Amortization

Miscellaneous

Additional Considerations

Tech startups may need to create additional accounts to track specific business activities, such as research and development costs, customer acquisition costs, and marketing campaign costs.

Tech startups that are raising venture capital may need to create additional accounts to track their fundraising activities, such as convertible notes and warrants.

Tech startups that are growing rapidly may need to revisit their chart of accounts on a regular basis to make sure that it is still meeting their needs.

Conclusion

A well-designed chart of accounts is essential for any business, but it is especially important for tech startups. By following the general principles and recommended accounts outlined in this article, you can create a chart of accounts that will help you track your financial performance and make informed business decisions.