We are Tech Founders funding tech startups

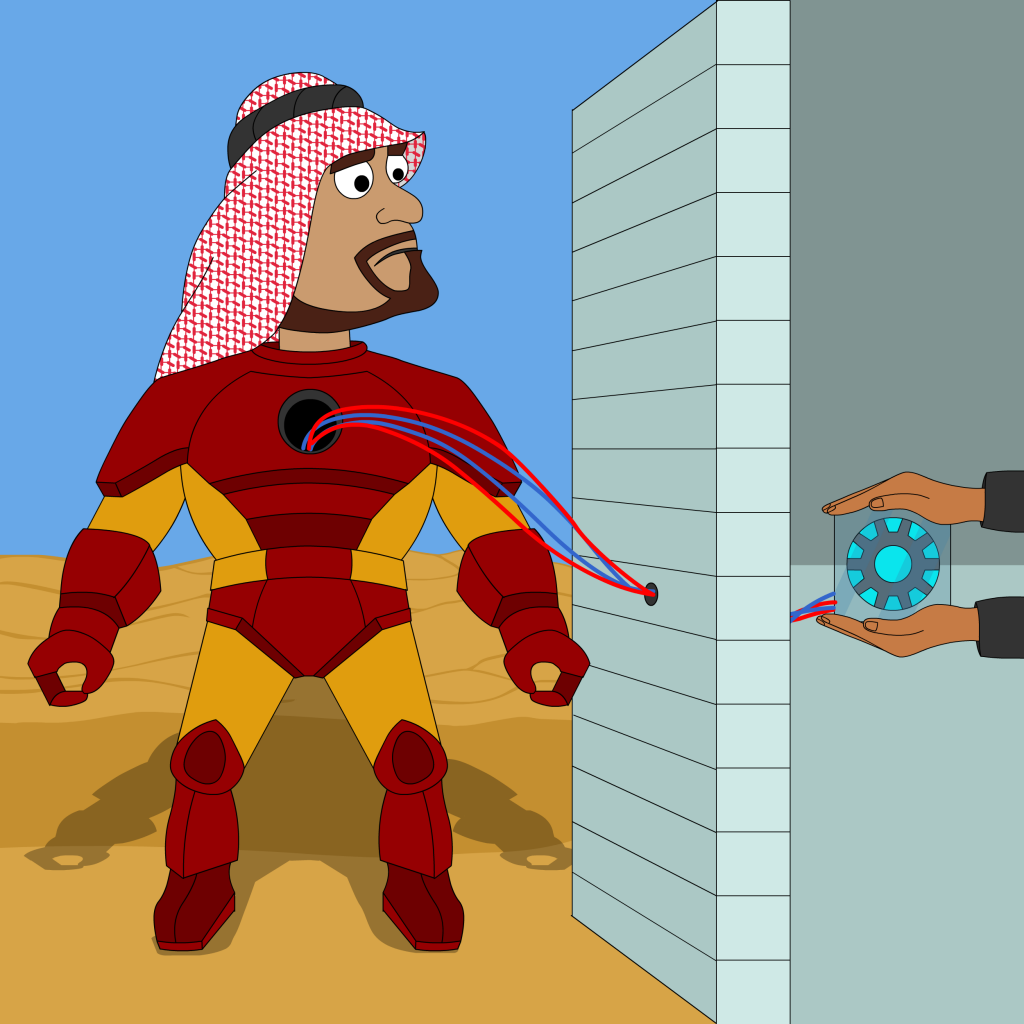

We are the champions of first money in into MENA tech startups.

Said differently, we want to give you your first investment cheque.

If you are a MENA based startup, with a founding team that has complementary skill sets, then we sure want to talk to you, please apply below for funding.

About

Welcome to Nama Ventures!

Nama Ventures is an early stage venture capital fund focused on fueling innovation in the MENA region, particularly in Saudi Arabia.

Nama Ventures prides itself on being an investment fund committed to nurturing ideas that guide founders to create exceptional companies.

If you are an entrepreneur who is ready to take the entrepreneurial plunge, it would be our privilege to join you on the start of your journey.

Nama Ventures is built upon the fundamental idea of enabling entrepreneurs to succeed. And as founders of Nama, we are thrilled to finally have the platform to implement this idea. Our hope is that entrepreneurs willing to partner with us will see and feel our value-add approach to investing.

Let’s take a ride down this road together.

TEAM

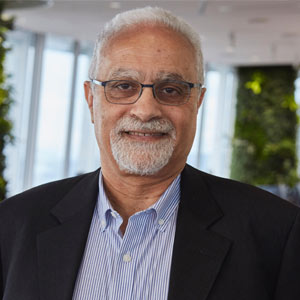

- Engineer turned engineering manager, entrepreneur turned tech investor.

- Failed as an entrepreneur a bunch of times till I was able to build a winner.

- Made numerous investments in both startups and funds along the years, 45 and counting, some failed miserably, some turned out great, two became unicorns and two are hopefully on their way.

- Currently the Managing Partner of Nama Ventures, a Venture Capital fund focused on fueling technology innovation in MENA, particularly in KSA.

- A member of many Angel Networks including Sand Hill Angels in Silicon Valley, Founding board member of Riyadh Angel Investors in Riyadh, and an advisor with Woman Spark in KSA.

- Co-founded Tech Wadi in Silicon Valley and I’m an advisor to numerous MENA tech incubators, accelerators and startups.

- I hold an MBA from London Business School and a BS in Electrical Engineering from Brigham Young University.

- Technical Certs: CCIE, MCSE, CCSP, and MCDBA. Also paid my coding dues in low level C, C++ & Java.

INVESTMENTS

Nama Ventures Fund I Portfolio Companies

Team's Individual Investments

ADVISORS

Taher Elgamal

"The father of SSL" , Salesforce , Netscape

Samih Toukan

Maktoob, Souq, Jabbar, etc...

Ronaldo Mouchawar

Mentor, Souq Founder, Amazon MENA

Fahad AlSharekh

TECHINVEST, Sakhr, Global Investment House

Majed Al Suwaidi

MD Dubai Media City

Akram Assaf

CTO Bayt.com

Amal Dokhan

CEO GEN Saudi, advisor Babson, World Bank

Antoine Hage

Rakuten, KYUBE, Yellow Pages, SOAJS, etc...

Basil Hashem

Netscape, Yahoo!, Admob, VMware, multiple startups, etc.

Ihsan Jawad

Zawya , Honeybee Ventures, etc...

Terry Kane

Facebook - Head of Marketing META

Ray Milhem

Cisco, Motorola, Techwadi, DSO, etc...

Lina Shehadeh

Marcom, CMO Aramex

Lateefa Alwaalan

Managing Director, Endeavor Saudi, Yatooq

Abdulmajeed Alsukhan

Nana, Tamara

CRITERIA

We have some basic filters that we use to gauge startups. Below are what we look for in a startup

COMPLEMENTARY TEAMS

Notice the word “team.” Creating a solo startup can be awfully lonely. We invest in teams, it's our most important criteria

TOUGH PROBLEMS

We like to see a tough problem presented—and then your solutions to address it. If you choose to go the entrepreneurial route, make sure you are trying to solve at least one hard problem. Hard is good; hard is interesting.

TRANSACTIONS

We love seeing a transaction where you are earning revenue selling a product or providing a service. This makes us bigger fans of eCommerce, for instance, than gaming startups.

FIRST MONEY IN

We want to be right there investing in you after you have your three F’s (friends, family, and founders). We are a pre seed fund and we want to stay that way. We want to be the first institutional capital that you raise.

DON'T OUTSOURCE YOUR CORE

We don’t want to see just an idea, where your core is outsourced. Your team has to have the Doers and the Sellers, the Doer being a technical co-founder

WE LIKE TO LEAD

"Nama" in Arabic is derived from the word meaning "to grow", and we can't help you grow if we are taking a backseat and watching others grow around you! We want to be there helping you grow from a seed to a forest, rolling up our sleeves and pruning you to realize and reach your full growth potential.

PASSION

The entrepreneurial journey is an emotional rollercoaster, some days you'll feel you are on top of the world, other days you'll feel underground. Only passion will carry you thought these times and give you the needed push to persevere.

GOOD PEOPLE

If you are not willing to lend a helping hand along your entrepreneurial journey then you are in the wrong profession. Entrepreneurship is a team sport, there is no place in it for arrogance and meanness. you have to be willing to always learn and always teach.

CONTACT

Please don’t hesitate to reach out to us using the form below and we’ll make sure to respond in a timely fashion.

If you are looking for funding, please don’t use the form below and instead click here

Copyright © 2020 – 2021 Nama Ventures – All Rights Reserved.