A startup is a company that is in its early stages of operation with a unique business idea, a product or a service, and aims to grow rapidly. In order to achieve growth, startups need funding. This is where venture capital comes in.

Venture capital is a type of private equity investment that provides capital to startups and early-stage companies. The goal of venture capital is to invest in companies that have high growth potential and offer the possibility of a significant return on investment.

Venture capital has become a popular funding method for startups due to its ability to provide growth capital without diluting equity. Additionally, venture capital firms bring expertise, mentorship, and networking opportunities to startups, which can be invaluable for their growth and success.

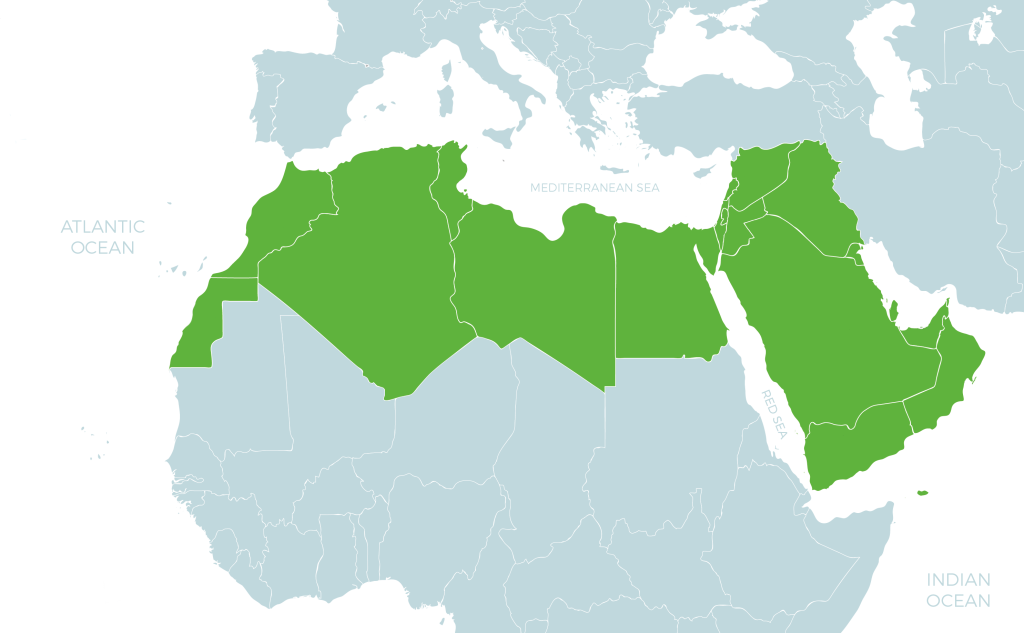

In recent years, venture capital has become increasingly popular in the Middle East and North Africa (MENA) region. With the rise of innovative startups in the region, investors are eager to support and nurture these businesses to help drive economic growth. Moreover, the MENA region has a large and growing pool of young and educated talent, which has attracted investors looking for new investment opportunities.

As the venture capital scene in the MENA region continues to grow, we can expect to see more and more investments in startups and early-stage companies. Additionally, we can expect to see the creation of more specialized venture capital firms, such as Nama Ventures, that focus on investing in the region’s unique and dynamic startups.

In conclusion, venture capital is a critical component for startups and early-stage companies in the MENA region. With a growing pool of investment opportunities and specialized venture capital firms like Nama Ventures, the future of the region’s startup scene looks bright.